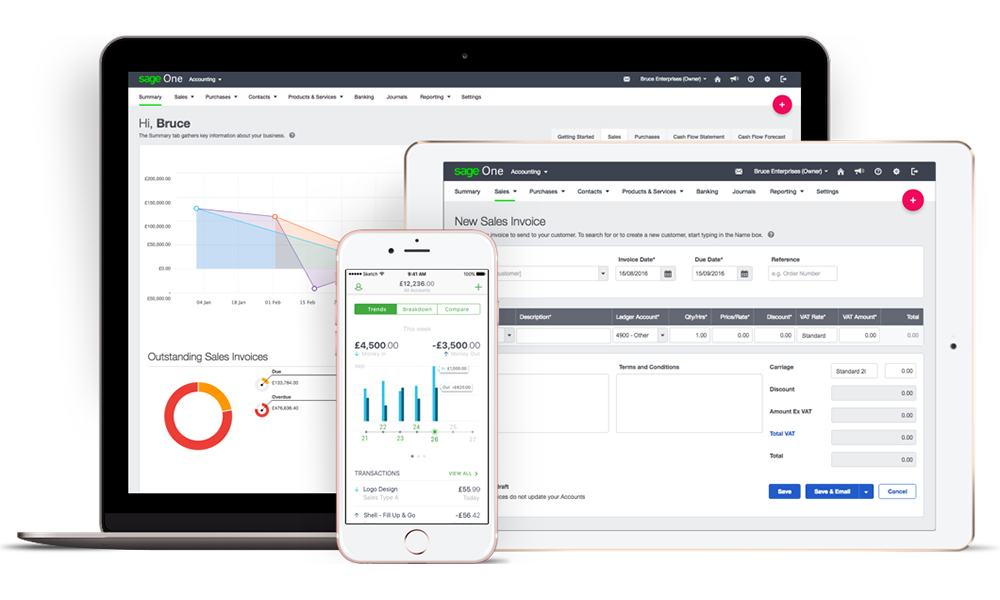

Sage One Accounting: Need a simple, yet powerful accounting solution? This isn’t your grandpa’s ledger book – Sage One brings modern accounting to your fingertips, whether you’re a solopreneur slinging artisanal coffee or a small team running a thriving online boutique. We’ll break down everything from its core features and integrations to its mobile app and killer reporting capabilities, comparing it to competitors like Xero along the way.

Get ready to ditch the spreadsheets and embrace the ease of streamlined accounting.

This guide dives into the nuts and bolts of Sage One Accounting, exploring its functionality, user experience, and overall value proposition for different business sizes. We’ll cover everything from setting up your account and migrating data to leveraging its reporting features and maximizing its integrations with other essential business tools. We’ll also tackle common questions and concerns to help you decide if Sage One is the right fit for your business needs.

Sage One Accounting Features

Sage One Accounting is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features aimed at simplifying accounting tasks, from invoicing and expense tracking to financial reporting. Its ease of use and affordability make it a popular choice for those looking to manage their finances without the complexities of larger, more expensive systems.

Core Functionalities of Sage One Accounting

Sage One provides a comprehensive suite of tools for managing a business’s finances. Key features include invoicing and billing, allowing users to create and send professional invoices, track payments, and manage outstanding balances. Expense tracking is streamlined through the ability to categorize and record expenses, often with the option to connect bank accounts for automated data import. Financial reporting offers customizable reports, providing insights into profitability, cash flow, and other key financial metrics.

Additionally, it usually includes bank reconciliation tools to ensure accurate financial records. Sage One also frequently offers inventory management features for businesses that need to track stock levels.

Comparison of Sage One Accounting and Xero

Both Sage One and Xero are popular cloud-based accounting solutions, but they cater to slightly different needs. While both offer core accounting features like invoicing and expense tracking, Xero generally boasts a more extensive range of add-ons and integrations, making it a more flexible choice for businesses with complex needs. Sage One, on the other hand, often presents a simpler, more intuitive interface, which can be beneficial for users who prioritize ease of use over extensive customization options.

Xero might be preferred by businesses requiring robust project management features or advanced inventory tracking, while Sage One might suit those focusing on core accounting functions without needing extensive third-party integrations. The choice depends on the specific needs and priorities of the business.

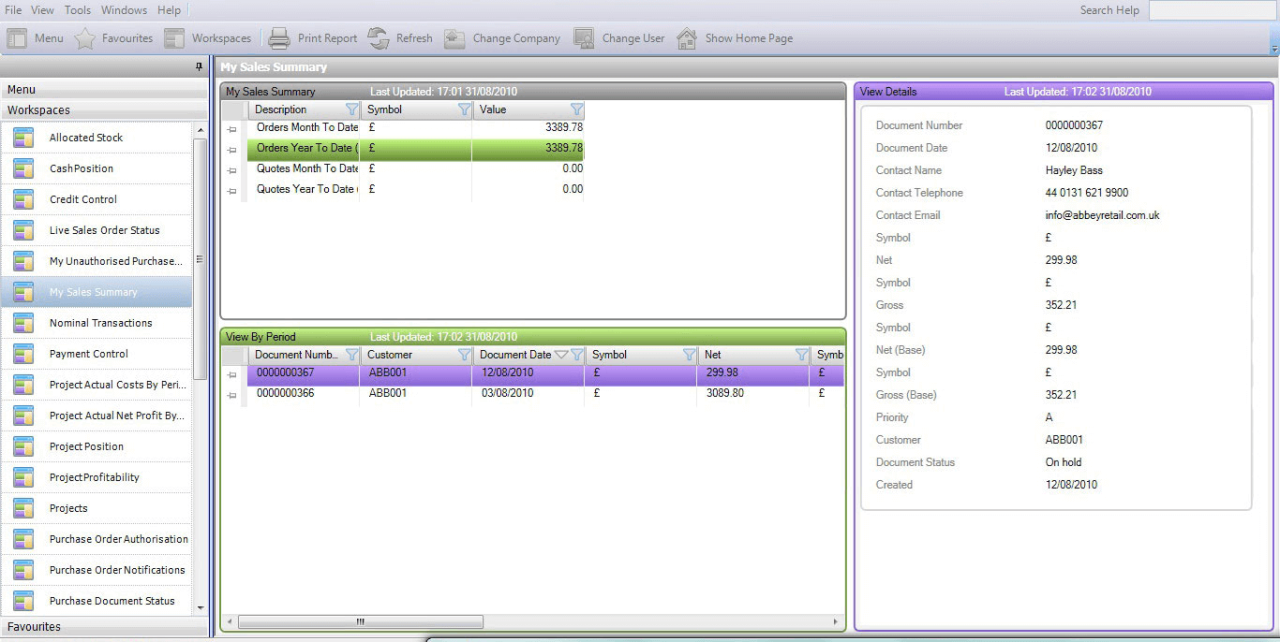

User Interface and User Experience of Sage One Accounting

Sage One generally prioritizes a clean and intuitive user interface. The dashboard typically displays key financial metrics at a glance, providing a quick overview of the business’s financial health. Navigation is usually straightforward, allowing users to easily access the features they need. The software’s design often aims for simplicity, making it accessible to users with limited accounting experience.

While the level of customization might be less extensive than some competitors, the focus on ease of use makes it a user-friendly option for many small businesses.

Sage One Accounting Pricing Tiers and Features

The following table Artikels a general comparison of Sage One’s pricing tiers and included features. Note that pricing and specific features can change, so it’s always best to check the official Sage One website for the most up-to-date information.

| Plan Name | Price (Approximate Monthly) | Number of Users | Key Features Included |

|---|---|---|---|

| Starter | $10 – $15 | 1 | Invoicing, expense tracking, basic reporting |

| Standard | $20 – $30 | 2-3 | All Starter features, plus more advanced reporting, inventory management |

| Premium | $30 – $40+ | 3+ | All Standard features, plus more users, enhanced support, potentially additional integrations |

Sage One Accounting Integrations

Sage One Accounting’s power significantly expands when integrated with other business applications. These integrations streamline workflows, reduce manual data entry, and provide a more holistic view of your business finances. Choosing the right integrations depends on your specific business needs and priorities.Sage One boasts a robust API, allowing for seamless connections with a variety of third-party apps. This interconnectedness allows for automation and enhanced data flow between different parts of your business operations.

However, it’s crucial to consider potential compatibility issues, the cost of integrations, and the learning curve associated with using new software.

Third-Party Applications and Their Integrations

Several popular applications integrate smoothly with Sage One Accounting. These include CRM systems (like Salesforce and HubSpot), e-commerce platforms (such as Shopify and WooCommerce), and project management tools (like Asana and Trello). The choice of integration depends heavily on the specific needs of a business. For example, a small e-commerce business would benefit most from integrating their sales data directly into Sage One, while a larger business might prioritize CRM integration for improved customer relationship management.

Benefits and Drawbacks of Integrations

Integrating Sage One with other applications offers numerous advantages. Data synchronization eliminates manual data entry, saving time and reducing errors. A unified view of business data provides more accurate insights into financial performance and customer behavior. Improved workflow efficiency leads to increased productivity and better decision-making.However, integrations are not without their challenges. Setting up and maintaining integrations can require technical expertise or professional assistance.

Data security concerns need to be addressed, ensuring that sensitive financial information is protected. Costs associated with integration services and subscription fees for third-party applications should be considered. Finally, potential compatibility issues between different software systems may require troubleshooting and technical support.

Examples of Workflow Efficiency Improvements

Imagine a scenario where a small business uses Shopify for e-commerce and Sage One for accounting. Integrating these two systems automatically transfers sales data from Shopify to Sage One. This eliminates the need for manual data entry, reducing the risk of human error and freeing up time for other tasks. Similarly, integrating a CRM system with Sage One provides a comprehensive view of customer interactions and their associated financial transactions, enabling more targeted marketing and improved customer service.

This integrated approach allows for a more holistic understanding of the customer lifecycle and its financial impact.

Workflow Diagram: Sage One Accounting and CRM Integration

Imagine a workflow diagram depicting the integration between Sage One Accounting and a CRM system (e.g., Salesforce). The diagram would show a two-way data flow. First, a new customer is added to the CRM system. This information, including contact details, is then automatically transferred to Sage One Accounting. Conversely, when an invoice is generated in Sage One, the payment status is updated in the CRM, providing real-time visibility into customer payment history.

This seamless exchange eliminates manual data entry and ensures both systems maintain consistent and up-to-date information. The diagram would visually represent this flow using arrows and boxes representing each system and data transfer points. This visual representation would clearly illustrate the enhanced efficiency and reduced manual intervention.

Sage One Accounting Reporting Capabilities

Sage One Accounting offers a robust suite of reporting tools designed to give you a clear picture of your business’s financial health. These reports aren’t just static snapshots; they’re dynamic tools you can customize and manipulate to gain valuable insights and make informed decisions. Understanding how to use these reports effectively is key to maximizing your use of Sage One.

The reporting capabilities in Sage One go beyond basic income statements and balance sheets. The system provides a wide range of pre-built reports, covering everything from profit and loss to cash flow and sales tax, allowing you to track key performance indicators (KPIs) and monitor your financial progress. Furthermore, the ability to customize these reports and export them in various formats enhances their usefulness for analysis and communication.

Report Types and Examples

Sage One provides a variety of standard reports, including Profit & Loss statements (showing revenue, expenses, and net profit over a specific period), Balance Sheets (showing assets, liabilities, and equity at a specific point in time), Cash Flow Statements (tracking the movement of cash in and out of your business), and Sales Tax Reports (summarizing sales tax collected and remitted).

Beyond these fundamentals, you’ll also find reports on accounts receivable (money owed to your business), accounts payable (money your business owes), and detailed customer and vendor activity. For example, a detailed sales report might break down sales by product, customer, or sales representative, providing granular insights into sales performance.

Report Customization

Sage One allows for significant report customization. You can filter reports by date range, customer, product, or any other relevant criteria. For instance, you could generate a Profit & Loss statement specifically for the last quarter, or a sales report focusing solely on a particular product line. You can also choose which columns are displayed in your reports, allowing you to focus on the most critical metrics for your business.

This level of customization ensures the reports are tailored to your specific needs and provide the information most relevant to your decision-making process.

Exporting Reports

Once you’ve generated a report, you can easily export it to several common file formats. This allows you to share the data with colleagues, accountants, or other stakeholders, or to import it into other software applications for further analysis. The most common export options include PDF (for easy sharing and printing), and Excel (for detailed manipulation and analysis within spreadsheets).

The export process typically involves selecting the report you wish to export, choosing the desired format, and specifying a file name and location for saving. This seamless export functionality enhances the practicality and usability of the Sage One reporting system.

Interpreting Key Financial Metrics

Understanding and interpreting the key financial metrics within Sage One reports is crucial for effective business management. For example, the Gross Profit Margin (Gross Profit / Revenue) shows the profitability of your sales after deducting the cost of goods sold. A higher gross profit margin indicates greater efficiency in managing costs. The Net Profit Margin (Net Profit / Revenue) reveals your overall profitability after all expenses are considered.

Analyzing the Current Ratio (Current Assets / Current Liabilities) helps assess your business’s short-term liquidity, indicating its ability to meet its immediate financial obligations. A strong understanding of these and other key ratios allows for proactive management and informed strategic decisions. For instance, a declining net profit margin might signal the need to review expenses or pricing strategies.

Similarly, a low current ratio might indicate a need to improve cash flow management or secure additional financing.

Sage One Accounting User Support

Navigating any new software can be tricky, and accounting software is no exception. Fortunately, Sage One Accounting offers several avenues for users to get the help they need, ensuring a smoother transition and ongoing support as they manage their finances. Understanding these options and their effectiveness is key to maximizing your experience with the software.Sage One Accounting provides a multi-pronged approach to customer support, recognizing that different users prefer different methods of communication.

The availability and effectiveness of these methods can vary depending on factors like the time of day and the complexity of the issue. This section will analyze the various support channels to help you determine which option best suits your needs.

Support Channels Available

Sage One offers a range of support channels designed to cater to various user preferences and technical skills. These include online help resources, phone support, and email support. The online help section contains a comprehensive knowledge base, FAQs, and tutorials. Phone support provides direct access to trained representatives, while email support allows for asynchronous communication, ideal for less urgent issues.

Comparative Analysis of Support Channel Effectiveness

The effectiveness of each support channel varies depending on the user’s needs and the nature of the problem. The online help resources are generally a good starting point for common issues, providing quick answers and solutions. However, for more complex problems or those requiring immediate attention, phone support is usually the most effective option, allowing for real-time interaction with a support representative.

Email support, while convenient, can be slower, with response times varying depending on the volume of inquiries. Therefore, choosing the right channel depends on the urgency and complexity of your issue.

Quality and Responsiveness of Customer Support

Generally, Sage One Accounting receives positive feedback regarding the quality and responsiveness of its customer support. Many users appreciate the availability of multiple support channels and the generally helpful and knowledgeable nature of the support staff. However, as with any support system, there can be variations in response times and the quality of assistance received depending on the specific representative and the time of day.

Some users have reported longer-than-desired wait times during peak periods, while others have praised the quick resolution of their issues. Ultimately, the experience can be subjective.

Frequently Asked Questions and Answers

Before contacting support, reviewing these frequently asked questions might resolve your issue quickly.

- Q: How do I create a new invoice in Sage One Accounting? A: Navigate to the “Invoices” section, click “New Invoice,” and enter the necessary client information and line items.

- Q: What reports can I generate in Sage One Accounting? A: Sage One offers a variety of reports, including profit and loss statements, balance sheets, and sales reports. The specific reports available may vary depending on your subscription level.

- Q: How do I connect my bank account to Sage One Accounting? A: Sage One supports bank feeds. You’ll need to connect your account using your banking credentials (following the secure authentication process) to import transactions automatically.

- Q: I forgot my password. How do I reset it? A: Click the “Forgot Password” link on the login page and follow the instructions to reset your password via email.

- Q: What types of integrations does Sage One Accounting offer? A: Sage One integrates with a variety of third-party applications, including popular e-commerce platforms and CRM systems. Specific integrations depend on your plan and may require separate subscriptions.

Sage One Accounting Security Features

Protecting your business data is paramount, and Sage One Accounting takes this responsibility seriously. They employ a multi-layered approach to security, ensuring your financial information remains confidential and accessible only to authorized individuals. This includes robust measures for data encryption, access control, and compliance with relevant regulations.Sage One Accounting’s security measures go beyond basic protection. It’s designed to safeguard your data from unauthorized access, use, disclosure, disruption, modification, or destruction.

This commitment extends to proactive measures to prevent security breaches and reactive steps to mitigate any potential incidents.

Data Encryption Methods

Sage One Accounting uses various encryption methods to protect data both in transit and at rest. Data in transit, meaning data traveling between your computer and Sage One’s servers, is typically secured using HTTPS (Hypertext Transfer Protocol Secure), which encrypts the communication channel. Data at rest, meaning data stored on Sage One’s servers, is encrypted using industry-standard encryption algorithms to prevent unauthorized access even if a server were compromised.

While the specific algorithms aren’t publicly disclosed for security reasons, the commitment to robust encryption is evident in their security practices. Think of it like a high-security bank vault – multiple layers of protection are in place.

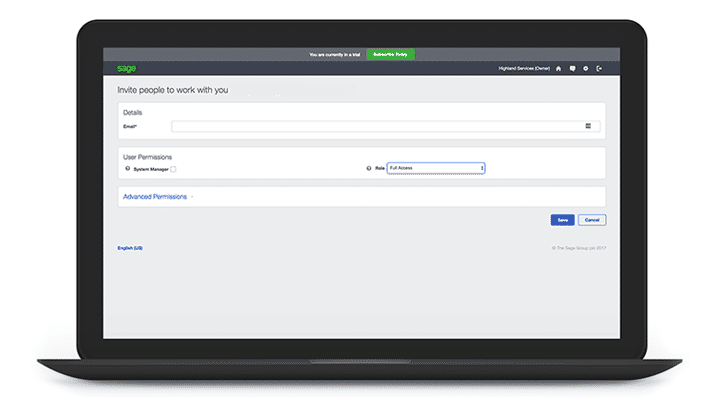

User Permissions and Access Control

Managing user permissions and access control is crucial for maintaining data security. Sage One Accounting allows administrators to assign specific roles and permissions to individual users. This granular control ensures that each user only has access to the data and functionalities necessary for their role. For example, an accountant might have full access to all financial data, while a sales representative might only have access to customer information related to their sales.

This prevents accidental or malicious access to sensitive information. The system also allows for the easy revocation of access if an employee leaves the company or their role changes.

Compliance with Data Privacy Regulations

Sage One Accounting is designed to comply with relevant data privacy regulations, such as GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in California. This means they implement measures to ensure the lawful processing of personal data, provide individuals with control over their data, and maintain appropriate security measures to protect against unauthorized access or disclosure.

Compliance is an ongoing process, and Sage One continually updates its security practices to adapt to evolving regulatory requirements. This commitment to compliance demonstrates their dedication to protecting user data and maintaining trust.

Sage One Accounting Mobile App Functionality

Sage One Accounting’s mobile app brings the power of your accounting software right to your fingertips, allowing you to manage your finances on the go. It’s designed for quick access to key information and streamlined task completion, though naturally it offers a subset of the features found in the full desktop application. This makes it perfect for checking on account balances, approving invoices, or quickly entering expenses while you’re out and about.The mobile app provides a simplified, touch-friendly interface compared to the desktop version.

While the desktop version offers a more comprehensive feature set and a more detailed view of your accounting data, the mobile app prioritizes ease of use and speed for essential tasks. Think of it as a powerful, portable snapshot of your business finances. You won’t find the same level of customization or in-depth reporting options, but the core functions are readily available and intuitive.

Mobile App Feature Overview

The Sage One Accounting mobile app offers a range of features designed for quick access to essential accounting data and task completion. Users can view account balances, track income and expenses, and manage invoices. The app also provides notifications for important updates, such as overdue invoices or low account balances, ensuring users stay informed about their financial situation.

The app’s streamlined design makes it easy to navigate and use, even for users who are not familiar with accounting software. Specifically, users can view real-time financial snapshots, access recent transactions, and even snap photos of receipts for easy expense tracking.

Mobile App versus Desktop Version

The mobile app offers a streamlined experience compared to the desktop version. While the desktop version provides comprehensive features and detailed reporting capabilities, the mobile app focuses on providing quick access to essential information and task completion. For example, creating detailed reports or customizing dashboards is more readily available on the desktop. The mobile app excels at quick checks of account balances, approving invoices, and recording simple transactions.

It’s ideal for those who need to manage their finances on the go but don’t need the full power of the desktop application. Think of it as a lightweight, portable version, optimized for speed and ease of use on smaller screens.

Usability and Convenience of Mobile Access

The convenience of accessing accounting data via the mobile app is undeniable. Imagine being at a client meeting and needing to quickly check an invoice total – the mobile app allows you to do this instantly. Or perhaps you’re traveling and need to approve an urgent payment; again, the mobile app provides the solution. This immediate access reduces delays and allows for faster decision-making.

The intuitive interface and streamlined design minimize the learning curve, making it easy for anyone to use, regardless of their technical skills. The real-time data synchronization ensures that information is always up-to-date, regardless of whether you’re accessing it from your phone or your desktop.

Sage One accounting software is great for managing small business finances, but sometimes you need to compress those massive financial reports before emailing them to clients. That’s where a tool like winzip free download comes in handy. It’s super convenient for zipping up those files, making them easier to share without bogging down inboxes. Then, you can get back to focusing on your Sage One accounting tasks.

Approving Invoices via the Mobile App

Approving invoices on the Sage One Accounting mobile app is a straightforward process.

- Log in: Open the Sage One Accounting mobile app and log in using your credentials.

- Navigate to Invoices: Locate and tap on the “Invoices” or similar section within the app’s main menu.

- Select Invoice: Browse the list of invoices and select the invoice you wish to approve. The app typically displays a summary of the invoice details.

- Approve Invoice: Tap the “Approve” button or similar option. The app may prompt you to confirm your approval.

- Confirmation: Once approved, the app will usually provide a confirmation message and update the invoice’s status.

Sage One Accounting for Different Business Sizes

Sage One Accounting, while a powerful tool, isn’t a one-size-fits-all solution. Its suitability depends heavily on the size and complexity of your business. Small businesses often find it perfectly adequate, while larger enterprises might outgrow its capabilities. Understanding these nuances is crucial for choosing the right accounting software.Sage One Accounting’s strengths lie in its simplicity and ease of use, making it ideal for businesses with straightforward financial needs.

However, its limitations become apparent when dealing with intricate accounting processes or substantial transaction volumes. This section will explore these differences in detail, providing clarity on which businesses would find Sage One most beneficial.

Sage One Accounting’s Suitability for Small Businesses

Small businesses, typically defined as those with fewer than 50 employees and limited revenue, often find Sage One Accounting a perfect fit. Its user-friendly interface and streamlined features are easy to learn and manage, even without dedicated accounting expertise. The software efficiently handles basic accounting tasks like invoicing, expense tracking, and financial reporting, providing a clear overview of the business’s financial health.

The relatively low cost compared to more comprehensive enterprise solutions also makes it attractive to budget-conscious startups and small businesses. Examples include sole proprietorships, small retail shops, and freelance service providers. These businesses generally don’t require the advanced features or scalability of more robust accounting systems.

Limitations of Sage One Accounting for Larger Enterprises

Larger enterprises, with their complex organizational structures and high transaction volumes, often require more sophisticated accounting solutions than Sage One provides. Features like multi-currency support, advanced inventory management, and robust budgeting tools might be lacking or limited. The software may struggle to handle the sheer volume of transactions efficiently, potentially leading to performance issues. Furthermore, the integration options, while sufficient for smaller businesses, may not cater to the specialized needs of larger corporations, potentially hindering seamless data flow between different departments and systems.

Companies with multiple locations or subsidiaries might also find the software’s capabilities insufficient for managing their complex financial operations.

Business Types Best Suited for Sage One Accounting

Several business types can benefit significantly from using Sage One Accounting. These include:

| Business Type | Reasons for Suitability | Example | Potential Limitations |

|---|---|---|---|

| Freelancers/Sole Proprietors | Simple invoicing, expense tracking, and basic reporting. Easy to learn and use. | Graphic designer | Limited scalability for significant growth. |

| Small Retail Businesses | Inventory management (basic), sales tracking, and point-of-sale integration (limited options). | Local bookstore | May require additional inventory management software for larger inventories. |

| Small Service Businesses | Project tracking, invoicing, and expense management. | Cleaning service | Limited project management features for very complex projects. |

| Nonprofits (small) | Basic accounting functions, donor management (limited features). | Small local charity | May require more specialized nonprofit accounting software for complex grant management. |

Feature Comparison for Different Business Sizes

| Feature | Small Business (Under 10 Employees) | Medium Business (10-50 Employees) | Large Business (Over 50 Employees) |

|---|---|---|---|

| Invoicing | Fully sufficient | Sufficient, but may require customization | Likely insufficient; requires more advanced features |

| Expense Tracking | Fully sufficient | Sufficient, but potentially slow with high volume | Insufficient; requires more robust solutions |

| Reporting | Meets basic needs | May require add-ons or integrations for advanced reports | Insufficient; needs advanced reporting and analytics tools |

| Inventory Management | Basic needs met | May be limited; additional software may be needed | Insufficient; requires dedicated inventory management systems |

Sage One Accounting Implementation and Setup

Getting Sage One Accounting up and running is easier than you think! This section details the steps involved in setting up your account, migrating data, and optimizing the software for your business needs. We’ll walk you through the process, offering best practices to ensure a smooth transition.Setting up your Sage One Accounting account is a straightforward process. It involves creating an account, customizing your settings, and connecting your bank accounts.

Migrating data from another accounting software might require some extra steps, depending on the complexity of your existing data and the software you’re switching from. Finally, configuring Sage One correctly will maximize its potential and improve your workflow.

Account Setup

The initial setup involves creating a Sage One account, providing essential business information like your company name, address, and tax details. You’ll then select a subscription plan that suits your needs. Afterward, you’ll begin setting up your chart of accounts, which is the backbone of your financial records. This involves defining your income and expense accounts, ensuring they accurately reflect your business structure.

Finally, you’ll link your bank accounts for automatic transaction imports, simplifying reconciliation.

Data Migration from Other Accounting Software

Migrating data from another accounting system to Sage One requires careful planning. The process may involve exporting data from your old system (often in CSV format) and then importing it into Sage One. Be aware that the data mapping process – matching fields from your old system to Sage One’s – needs accuracy. Inaccurate mapping can lead to errors in your financial reports.

Sage One offers support documentation and potentially professional services to assist with complex migrations. For instance, a business moving from QuickBooks Desktop might need to carefully map their chart of accounts to ensure consistency.

Optimizing Sage One Accounting Configuration

Optimizing Sage One involves configuring various settings to streamline your workflow. This includes setting up automated backups, establishing user roles and permissions for team members, and customizing your dashboard to display the key metrics relevant to your business. For example, a small business owner might prioritize sales figures and cash flow, while a larger company might focus on profitability and inventory management.

Regularly reviewing and adjusting your settings is crucial for ongoing efficiency.

Implementation Checklist

Proper implementation requires a systematic approach. The following checklist provides a structured way to ensure a successful transition:

- Create a Sage One account and select a suitable subscription plan.

- Input your company details and set up your chart of accounts.

- Link your bank accounts for automated transactions.

- Migrate data from your previous accounting software, ensuring accurate mapping.

- Configure user roles and permissions.

- Set up automated backups.

- Customize your dashboard to reflect your key performance indicators (KPIs).

- Test all functionalities thoroughly before fully transitioning.

- Schedule regular training for your team.

- Establish a process for ongoing maintenance and updates.

Sage One Accounting Pricing and Value Proposition

Choosing the right accounting software hinges on a careful evaluation of pricing and the overall value it offers. Sage One Accounting, like other solutions, presents various pricing tiers, each designed to cater to businesses of different sizes and needs. Understanding the cost-benefit relationship is crucial for making an informed decision.Sage One Accounting’s pricing model typically involves subscription-based plans, with costs varying based on features included and the number of users.

Direct comparison with competitors like QuickBooks Online or Xero requires examining specific plan features side-by-side, as pricing can fluctuate. However, a general observation is that Sage One often positions itself as a competitively priced option, particularly for smaller businesses seeking a balance between functionality and affordability.

Sage One Accounting Pricing Compared to Competitors

A detailed comparison requires accessing the current pricing pages of each software provider (Sage, QuickBooks Online, Xero, etc.). Generally, you’ll find that basic plans across these platforms offer similar core accounting features, such as invoicing, expense tracking, and financial reporting. However, differences arise in features like inventory management, project accounting, or advanced reporting capabilities. Higher-tier plans usually unlock more advanced features and accommodate a larger number of users.

Comparing prices at the same feature level is key to a fair assessment. For example, a plan offering robust inventory tracking in one software might cost more than a basic plan in another, but provide better value for businesses needing that specific function.

Value Proposition of Sage One Accounting

Sage One Accounting’s value proposition rests on its blend of features, ease of use, and cost-effectiveness. Its intuitive interface makes it accessible even to users with limited accounting experience. The inclusion of features like automated bank reconciliation, customizable reports, and mobile accessibility enhances efficiency and saves time compared to manual processes. For businesses experiencing rapid growth, the scalability of Sage One’s plans allows for seamless upgrades as needs evolve.

The value increases significantly when considering the time saved on manual tasks, reduced risk of errors, and improved financial insights.

Return on Investment (ROI) of Sage One Accounting

Calculating the ROI of Sage One Accounting involves comparing the costs of using the software (subscription fees) against the benefits derived. Benefits include reduced labor costs (time saved on manual tasks), minimized errors leading to reduced financial penalties, improved financial decision-making through better insights, and enhanced operational efficiency. For example, a small business spending $300 annually on Sage One might save $500 in accounting fees and another $200 in time previously spent on manual bookkeeping.

This translates to a positive ROI of $400. The specific ROI will vary based on the business’s size, complexity of operations, and the level of Sage One features utilized.

Cost-Benefit Analysis: Sage One Accounting vs. Manual Accounting

The following table illustrates a simplified cost-benefit analysis comparing Sage One Accounting to manual accounting methods. Note that these figures are illustrative and can vary greatly depending on the business context.

| Factor | Manual Accounting | Sage One Accounting | Difference |

|---|---|---|---|

| Software/Subscription Cost | $0 | $300/year (example) | -$300 |

| Bookkeeper/Accountant Fees | $2000/year (example) | $500/year (example, reduced need for full-time assistance) | $1500 |

| Time Saved (estimated value) | $0 | $200/year (example) | $200 |

| Error Reduction (estimated value) | $0 | $100/year (example) | $100 |

| Total Annual Cost/Benefit | $2000 | $1100 | $900 Savings |

Concluding Remarks

Ultimately, Sage One Accounting offers a compelling blend of user-friendly design, robust features, and competitive pricing. While it might not be the perfect solution for every business (especially large enterprises with highly complex needs), its intuitive interface, comprehensive reporting tools, and strong mobile app make it an excellent choice for many small businesses and entrepreneurs. Whether you’re a seasoned accountant or a first-timer navigating the world of business finances, Sage One empowers you to manage your finances efficiently and effectively, allowing you to focus on what matters most – growing your business.

FAQ Explained

Is Sage One Accounting cloud-based?

Yes, it’s entirely cloud-based, meaning you can access your data from anywhere with an internet connection.

Can I try Sage One Accounting before committing?

Many providers offer free trials, so check their website for current options.

What types of businesses is Sage One best suited for?

It’s ideal for small businesses, freelancers, and startups with relatively straightforward accounting needs. Larger companies with complex financial structures might need a more comprehensive solution.

How secure is my data with Sage One?

Sage employs industry-standard security measures, including data encryption and robust access controls. Check their website for specific details on their security protocols.

What if I need help using Sage One?

Sage typically offers various support channels, including online help, phone support, and email support. The availability and quality of support may vary; check their website for current support options.